Every Little Thing You Need To Understand About Home Mortgages

Created by-Black MangumAs you plan to buy your new home, the idea of getting a mortgage will pop up frequently. You need to learn all you can before you pursue such a loan, but where can you get such an education? This article is the perfect place to start, so check out the advice below.

If your mortgage has been approved, avoid any moves that may change your credit rating. Your lender may run a second credit check before the closing and any suspicious activity may affect your interest rate. Don't close credit card accounts or take out any additional loans. Pay every bill on time.

Don't let one mortgage denial stop you from looking for a home mortgage. Just because one company has given you a denial, this doesn't mean they all will. Shop around and talk to a broker about your options. Finding a co-signer may be necessary, but there are options for you.

Check your credit report before applying for a mortgage. With today's identity theft problems, there is a slight chance that your identity may have been compromised. By pulling a credit report, you can ensure that all of the information is correct. If you notice items on the credit report that are incorrect, seek assistance from a credit bureau.

Do not go on a spending spree to celebrate the closing. Many times, lenders will check your credit before closing on the loan. Wait to buy your new furniture or other items until after you have signed your mortgage contract.

Get a pre-approval letter for your mortgage loan. A pre-approved mortgage loan normally makes the entire process move along more smoothly. It also helps because you know how much you can afford to spend. Your pre-approval letter will also include the interest rate you will be paying so you will have a good idea what your monthly payment will be before you make an offer.

Before beginning any home buying negotiation, get pre-approved for your home mortgage. That pre-approval will give you a lot better position in terms of the negotiation. It's a sign to the seller that you can afford the house and that the bank is already behind you in terms of the buy. https://www.nerdwallet.com/article/loans/personal-loans/how-do-bank-loans-work can make a serious difference.

Although using money given to you as a gift from relatives for your downpayment is legal, make sue to document that the money is a gift. The lending institution may require a written statement from the donor and documentation about when the deposit to your bank account was made. Have this documentation ready for your lender.

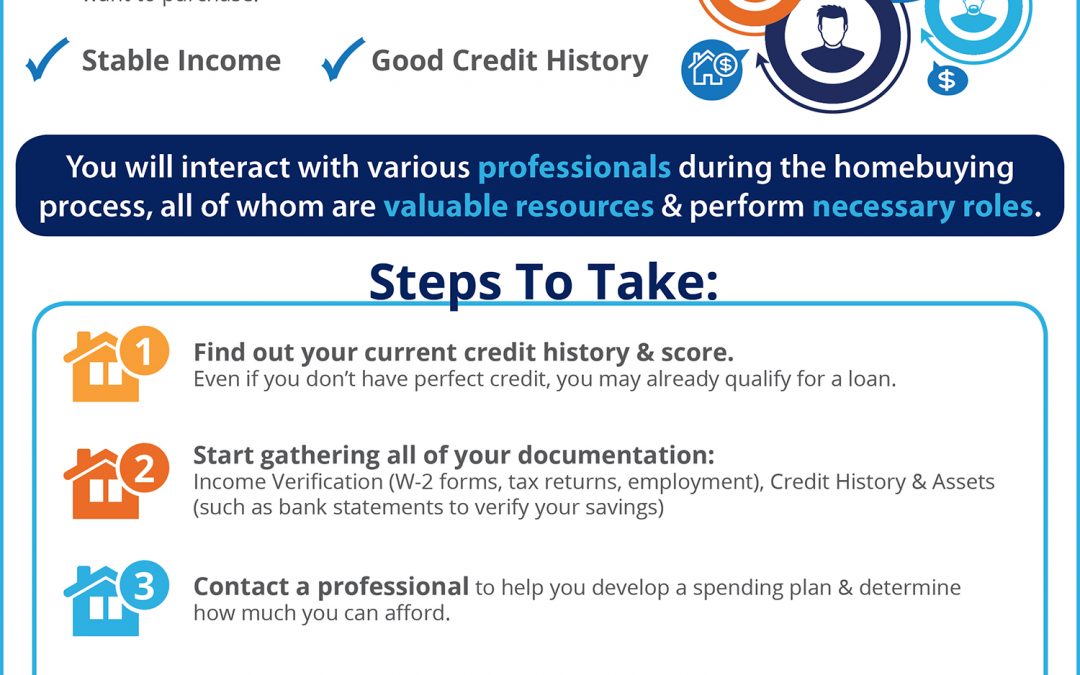

Have the necessary documents ready. There are a few documents that you'll be expected to have when you come in for a home mortgage. You'll need to provide bank statements, income tax reports, W-2 statements, and at least two pay stubs. Having these at the ready will help make your meetings go much quicker.

After you secure your loan, work on paying extra money to principal every month. It will help you pay the loan off quicker. Just $100 more each month could cut the length of the loan by as much as 10 years.

Avoid interest only type loans. With an interest only loan, the borrower only pays for the interest on the loan and the principal never decreases. This type of loan may seem like a wise choice; however, at the end of the loan a balloon payment is needed. This payment is the entire principal of the loan.

Be sure you understand all fees and costs related to any mortgage agreement you are considering. Ask the company to itemize each closing cost, including commissions and other charges. Certain things are negotiable with sellers and lenders alike.

Avoid dealing with shady lenders. Though many are legitimate, others are unscrupulous. If they offer strange financing options, with no money down, there is a good chance you are being taken. Avoid lenders that charge high rates and excessive fees. Avoid lenders that say a poor credit score is not a problem. Don't work with anyone who says lying is okay either.

Most financial institutions require that the property taxes and insurance payments be escrowed. This means the extra amount is added onto your monthly mortgage payment and the payments are made by the institution when they are due. This is convenient, but you also give up any interest you could have collected on the money during the year.

Many computers have built in programs that will calculate payments and interest for a loan. Use the program to determine how much total interest your mortgage rate will cost, and also compare the cost for loans with different terms. You may choose a shorter term loan when you realize how much interest you could save.

If the offer you get isn't great, look for a better one. There are Highly recommended Website during specific months or seasons. You may get a good deal from a company that just opens up, or perhaps government is offering some new program. Jest remember that waiting a bit could turn out to be best.

Don't be scared to wait for a better loan. During certain months of the year, a lot of terrific options will become available. You may also find a new lender who just opened, or the government may pass a new stimulus plan which could help you out. Remember that good things really do come to those who wait.

Do not charge up your credit cards or open new accounts if you have been approved for a mortgage. Many lenders get an additional credit report on the borrower a couple of days before closing on the loan. Your credit score can be hurt by maxed-out credit cards or new lines of credit. This can lead to your loan being denied at the last minute.

These tips about financing your home should help motivate you in the right direction. It may be daunting at first, but educating yourself about the facts will give you the confidence that you need to make educated choices. Using extra knowledge to supplement the information you already know can make your experience much smoother.